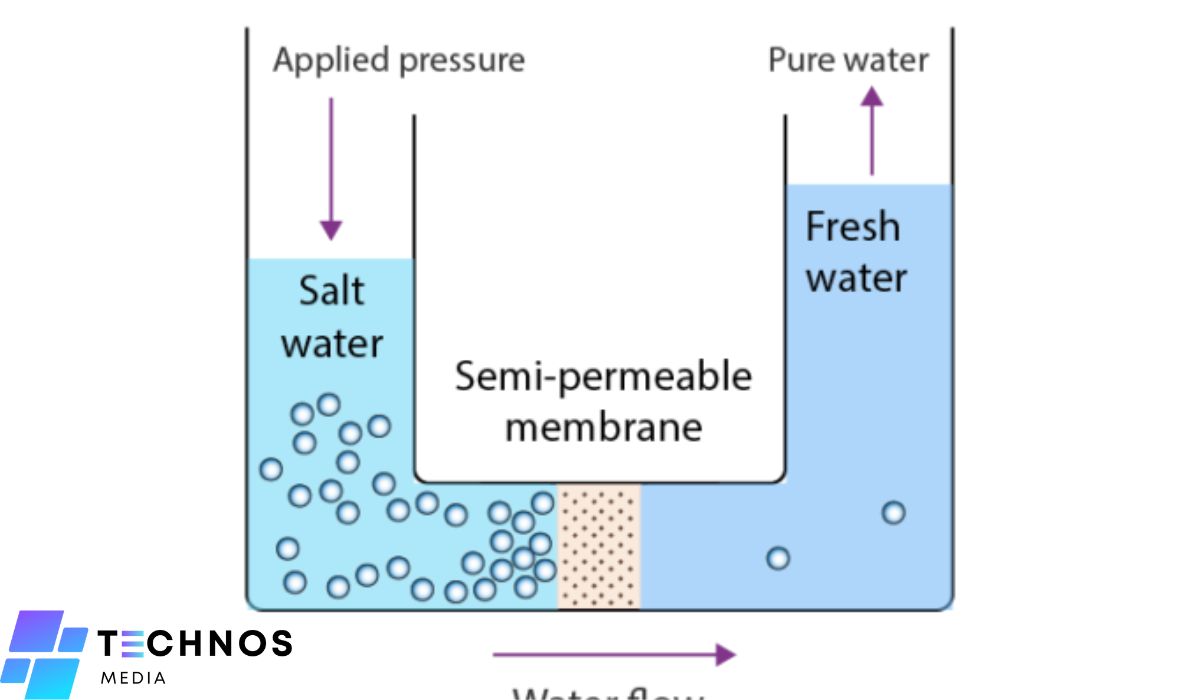

Can I Deduct a Reverse Osmosis System for My Business? Understanding Tax Benefits and Eligibility

Investing in a reverse osmosis system for your business can be a significant expense, but it may also provide tax benefits. Business owners often wonder whether such a system qualifies as a deductible expense. This article explores whether you can deduct a reverse osmosis system for your business, what tax laws apply, and how to maximize your deductions.

What Qualifies as a Deductible Business Expense?

Before determining whether a reverse osmosis system is tax-deductible, it’s essential to understand what qualifies as a deductible business expense. According to the IRS, an expense is deductible if it is:

-

Ordinary: Common and accepted in your industry.

-

Necessary: Helpful and appropriate for your business operations.

A reverse osmosis system may qualify under these criteria if it is necessary for providing clean water to employees, customers, or for business operations.

Can You Deduct the Full Cost of a Reverse Osmosis System?

The full cost of a reverse osmosis system may be deductible, but how it is deducted depends on the expense classification:

-

Immediate Deduction (Section 179): Under Section 179 of the IRS tax code, businesses can deduct the full cost of qualifying equipment in the year it is placed in service, rather than depreciating it over time.

-

Depreciation Deduction: If the system is considered a long-term asset, you may need to depreciate it over several years instead of taking an immediate deduction.

-

Partial Deduction as a Maintenance Expense: If the system is a minor expense, it may qualify as a regular maintenance cost and be fully deductible in the year of purchase.

Does a Reverse Osmosis System Qualify Under Section 179?

Section 179 allows businesses to deduct the full cost of eligible equipment purchased and put into service within the tax year. A reverse osmosis system may qualify under this provision if:

-

It is used for business purposes more than 50% of the time.

-

It is installed and operational within the tax year.

-

It meets the cost limits set by the IRS for Section 179 deductions.

If the system meets these requirements, business owners can claim an immediate deduction instead of depreciating the cost over time.

How Does Depreciation Work for a Reverse Osmosis System?

If the system does not qualify for an immediate deduction, it may need to be depreciated over time. The IRS classifies most equipment under the Modified Accelerated Cost Recovery System (MACRS), which determines the lifespan over which assets are depreciated. A reverse osmosis system typically falls under the 5 to 7-year depreciation category.

Using the MACRS method, business owners can deduct a portion of the system's cost each year until it is fully depreciated.

Are Installation Costs Deductible?

Yes, installation costs associated with a reverse osmosis system may be deductible. If the system is classified as equipment, installation costs can be added to the total cost of the system and included in the deduction or depreciation calculations. This includes:

-

Plumbing and electrical work

-

Permits and inspections

-

Labor costs

These costs should be documented carefully to maximize your deduction.

Can You Deduct Maintenance and Repairs?

Ongoing maintenance and repairs for a reverse osmosis system are typically deductible as regular business expenses. This includes:

-

Filter replacements

-

System cleanings

-

Repairs and part replacements

Since these costs are recurring and necessary for business operations, they can be deducted in the year they are incurred.

Are There Any Industry-Specific Deductions?

Some industries may have additional tax benefits for installing water purification systems, especially if clean water is a regulatory requirement. For example:

-

Restaurants and Food Service: Businesses that serve food may be required to meet specific water quality standards, making a reverse osmosis system a necessary expense.

-

Manufacturing: Facilities that require purified water for production may qualify for additional tax benefits.

-

Healthcare: Medical facilities and dental offices often require water purification systems, which may be classified as essential equipment.

Consulting a tax professional can help determine whether your industry qualifies for additional deductions.

What Tax Forms Do You Need to Deduct a Reverse Osmosis System?

To claim a deduction for a reverse osmosis system, business owners typically need to complete the following IRS forms:

-

Form 4562 (Depreciation and Amortization) if depreciating the cost over time.

-

Schedule C (Profit or Loss from Business) for sole proprietors and single-member LLCs.

-

Form 1120 (Corporate Income Tax Return) or Form 1065 (Partnership Return) for incorporated businesses.

Keeping detailed receipts and documentation of the purchase and installation is essential for tax reporting.

Can You Claim a Reverse Osmosis System as a Green Energy Deduction?

While reverse osmosis systems themselves do not qualify for energy-efficient tax credits, some businesses may benefit from state or local incentives for water conservation efforts. Additionally, if the system is part of a broader LEED certification or green initiative, there may be additional deductions or grants available.

Checking with local tax authorities and the EPA’s WaterSense program can help identify any applicable incentives.

How Can a Tax Professional Help Maximize Your Deduction?

Working with a tax professional can ensure that you:

-

Properly classify the system as a deductible expense or depreciable asset.

-

Claim any additional tax credits or industry-specific benefits.

-

Accurately file the necessary IRS forms.

-

Stay compliant with tax laws while maximizing your deduction.

A tax professional can also provide strategic planning to ensure that purchasing a reverse osmosis system aligns with your overall tax strategy.

Conclusion

A reverse osmosis system for your business may be deductible depending on its use, cost, and classification. Business owners can potentially deduct the full cost under Section 179, depreciate it over time, or claim ongoing maintenance and repair deductions. Understanding IRS rules and industry-specific benefits can help maximize tax savings. Consulting a tax professional ensures compliance and helps business owners take full advantage of available deductions.