GLP-1 Analogues Market Analysis by Size, Share, Growth, Trends and Forecast (2024–2032) | UnivDatos

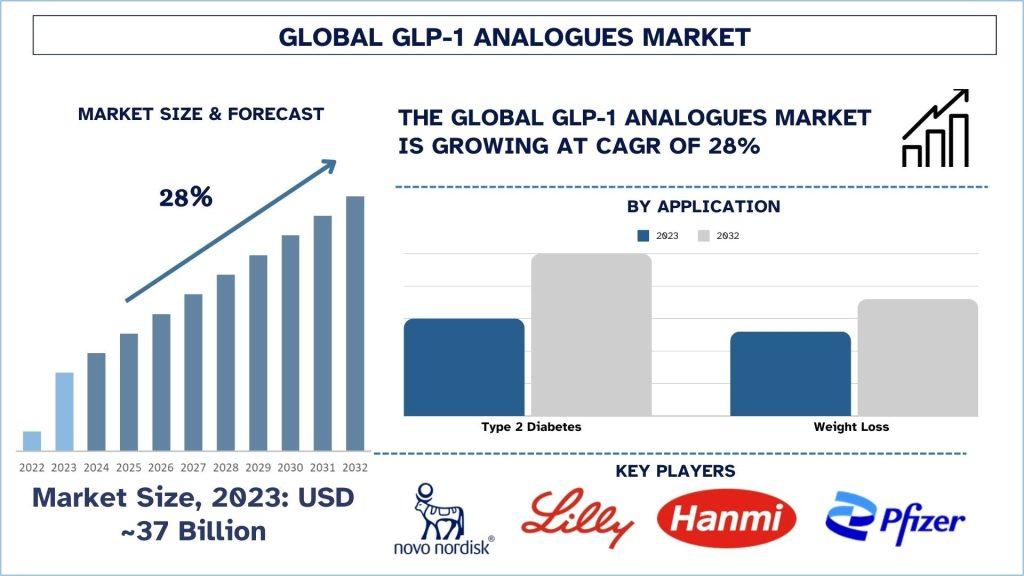

According to the UnivDatos Market Insights, the rising prevalence of type 2 diabetes and obesity, innovations such as oral formulations and long-acting drugs, increased patient awareness, and regulatory approvals drive the GLP-1 Analogues market. As per their “GLP-1 Analogues Market” report, the global market was valued at USD 37 Billion in 2023, growing at a CAGR of about 28% during the forecast period from 2024 - 2032 to reach USD Billion by 2032. The GLP-1 analogues market remains on the path to improvement, thanks to advances in research, the addition of new indications, and critical regulatory approvals. The emerging trends, especially in FDA approval recent past, have shown what the future holds regarding forward-looking therapy approaches for type 2 diabetes and obesity. FLR notwithstanding, these landmarks do signify a progressive evolution in the treatment paradigm but also foster the recognition of GLP-1 analogues as indispensable weapons in the war against metabolic disease. This article gives a comprehensive discussion of current FDA approvals and their impact on the market, the consumers (healthcare providers) as well as the patients.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=69030

Semaglutide: An Innovation in Oral Delivery Systems

Semaglutide, sold by Novo Nordisk as an injectable called Ozempic and as an oral tablet called Rybelsus, has attracted a lot of interest since the FDA greenlit additional uses. Recommended to treat type 2 diabetes at first, semaglutide is now approved for chronic weight management and marketed as Wegovy. It can be said that it is a unique achievement because, for the first time, glycemic control and significant weight loss are within reach at the same time.

The Medicines and Healthcare products Regulatory Agency (MHRA) on 23 July 2024, approved a new indication for semaglutide (Wegovy) to reduce the risk of overweight and obese adults suffering serious heart problems or strokes.

This medicine, a GLP-1 receptor agonist, was already approved for use in the treatment of obesity and for weight management, to be used alongside diet, physical activity and behavioural support.

Semaglutide in oral formulation has been one of the most significant developments because it has responded to injection phobia among patients. Several clinical studies have established the drug in decreasing HbA1c conveying weight loss themes, and establishing itself as a first-line recommendation for many individuals who are searching for non-surgical therapies. With the sanction of the FDA in the United States, its patients can be assured of the drug’s safety and the improving results in its usage.

Tirzepatide: A molecule that performs two functions to set new standards.

As a new drug class, Mounjaro, Eli Lilly’s tirzepatide, has been approved by the FDA as a dual glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 receptor agonist. This new drug boosts glycemic control and weight loss because it modulates two hormonal signaling networks. Clinical trials have claimed record results highlighting some patients to have shown HbA1c below 5.7% which non-diabetic people consider ideal.

Tirzepatide’s approval is a new revolutionary breakthrough in the management of diabetes because it fills gaps that have not been met by other classes of drugs. These professionals are bullish on its ability to reinvent treatment regimes for those suffering from obesity and type 2 diabetes in particular.

On December 4, 2024, Eli Lilly and Company (NYSE: LLY) announced topline results from the SURMOUNT-5 phase 3b open-label randomized clinical trial. Zepbound® (tirzepatide) provided a 47% greater relative weight loss compared to Wegovy® (semaglutide). On average, Zepbound led to a superior weight loss of 20.2% compared to 13.7% with Wegovy.i At 72 weeks, Zepbound beat Wegovy on both the primary endpoint and all five key secondary endpoints in this trial of adults living with obesity or overweight with at least one weight-related medical problem and without diabetes.

Combination therapies: New horizons

It also has been approved per combination therapies that involve GLP-1 analogue in the management of patients. For example, Sanofi’s Soliqua brand combines insulin glargine and lixisenatide, in a single product for treating type 2 diabetes. This dual-action formulation reduces the dosing regimens and thus improves patient compliance.

Combination therapies are becoming popular as they target various types of diabetes, for instance affecting insulin resistance and weight loss. These approvals indicate a paradigm shift in the approach toward solutions to some of the metabolic syndromes that are multiple and complicated.

The Weight Loss Revolution: Beyond Diabetes

This is now emerging as one of the largest emerging segments of the global GLP-1 analogues market – weight loss. This indication has sparked a renewed focus on other clinical applications of GLP-1 analogues besides diabetes after FDA approval of semaglutide for chronic weight management. This change corresponds to the emergency of obesity and its complications including cardiovascular diseases and hypertension.

The market is bringing new trials with GLP-1 analogues for obesity into focus More About The Market Obesity has been a subject of debate for a long time now and with the advancement in technology and studies, the market has been witnessing increased research on clinical trials involving GLP-1 analogues for obesity treatment. Calm support leaders such as Novo Nordisk and Eli Lilly are pushing for their remedies claiming that the products can be the go-to solution for getting a slimmer body. The FDA has a favorable view on such advancements and this move will create tremendous growth and expansion of this market.

On 4 June 2021 – Novo Nordisk announced that the US Food and Drug Administration (FDA) has approved Wegovy™ (the brand name for once-weekly semaglutide 2.4 mg injection in the US) for chronic weight management. Wegovy™ is indicated as an adjunct to diet and exercise for chronic weight management in adults with obesity (initial BMI≥30 kg/m2) or overweight (initial BMI≥27 kg/m2) with at least one weight-related comorbidity.

Patient-Centric Approaches: Enhancing Utilisation and Financing

Companies approve their products with the FDA, and now it’s time to concentrate on such patients’ access and specimens’ costs. The efforts include cost-sharing for medical services and products, insurance companies, patient information, and awareness campaigns. It’s all about minimizing patient’s financial and organizational burdens which would allow more people to avail themselves of these cutting-edge treatments.

Furthermore, some organizations use solutions that will enhance the levels of compliance and therapeutic results. Remote subtraction into type 2 diabetes GLP-1 analogue therapy regimes involves using mobile applications, remote monitoring, and telemedicine consultations.

Challenges Ahead: Cost and Accessibility

Nevertheless, there are some limitations concerning the accessibility of GLP-1 analogues with a fair cost for everyone. It is again noted that costs of treatment remain high a challenge especially in LMICs. Although FDA approval means that the drugs in question effectively treat chronic diseases and present no risk to patients, they can cost a great deal of money to healthcare systems and individuals.

However, the increasing market for GLP-1 analogues raised several concerns on the manufacturing forward and how robust the supply chain is. These problems need to be solved so that companies can meet the demand that is currently present around the world while at the same time ensuring they do not affect the quality or quantity of the product.

Click here to view the Report Description & TOC https://univdatos.com/report/glp-1-analogues-market/

Future Outlook: A Promising Horizon

The recent FDA approvals of the GLP-1 analogues show a new chapter in the war against diabetes and obesity. These developments do not only confirm the multiple benefits found in the use of GLP-1 analogues regarding therapy but also its shift toward other aspects of metabolic disharmonies.

With the evolution of corporate business and their diversification of product lines, the market for GLP-1 analogues is expected to show potential for development. There will be certain important trends that will help in molding the future of this market namely strategic partnerships, novel drug carriers, and patient-centric configuration. There are promising days for both healthcare providers and patients, as GLP-1 analogues set new benchmarks in metabolic disease treatment.

Related Healthcare Market Research Report

Anti-Aging Services Market: Current Analysis and Forecast (2024-2032)

Absorbable Antibacterial Envelope Market: Current Analysis and Forecast (2024-2032)

Diabetic Foot Ulcer Market: Current Analysis and Forecast (2024-2032)

Inflammatory Bowel Disease Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/