Usage-Based Insurance for Automotive Market Size, Share, Trends, Demand, Growth and Opportunity Analysis

Global Usage-Based Insurance for Automotive Market – Industry Trends and Forecast to 2028

Global Usage-Based Insurance for Automotive Market, Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD) and Manage-How-You-Drive (MHYD)), Technology (OBD II, Black Box, Smartphones and Others), Vehicle Type (Passenger Auto and Commercial Auto), and Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa) Industry Trends and Forecast to 2028.

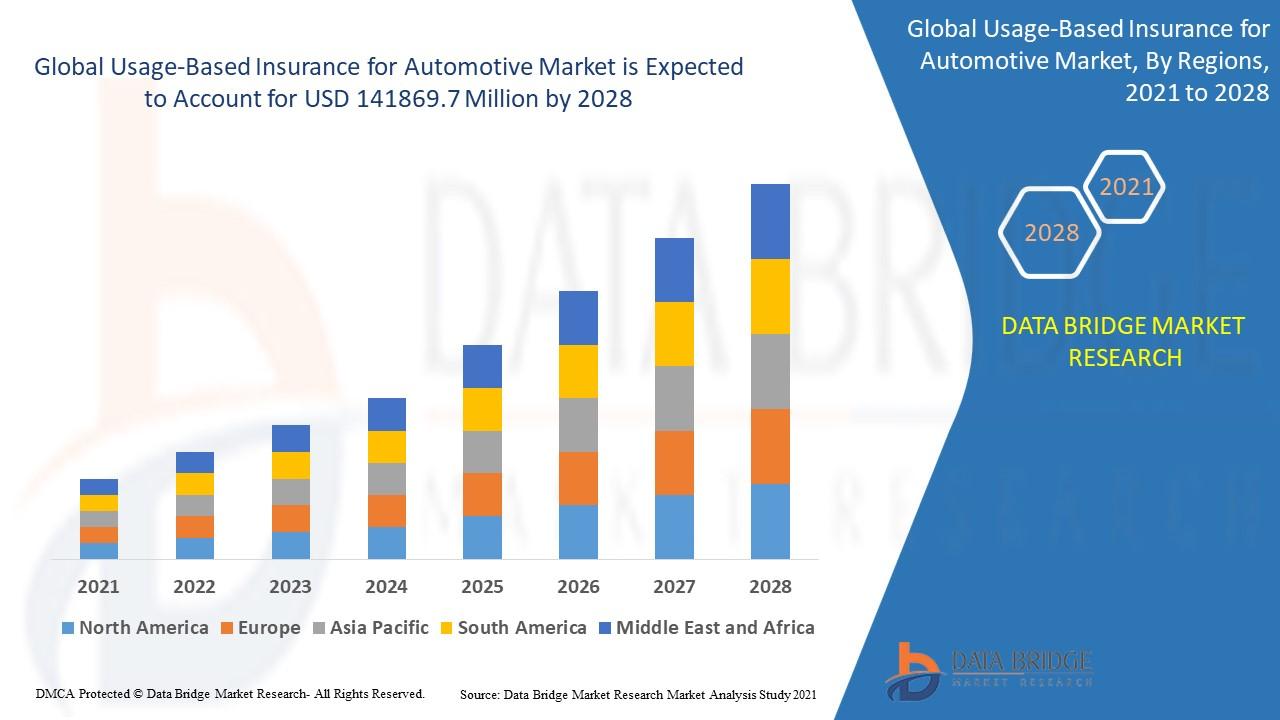

The usage-based insurance for automotive market is expected to witness market growth at a rate of 22.30% in the forecast period of 2021 to 2028 and is expected to reach USD 141869.7 million by 2028. Data Bridge Market Research report on usage-based insurance for automotive market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the penetration of usage-based insurance is escalating the growth of usage-based insurance for automotive market.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-for-automotive-market

**Segments**

- On the basis of technology, the global usage-based insurance for the automotive market can be segmented into OBD-II-Based UBI, smartphone, hybrid, black-box, and others. OBD-II-based UBI is witnessing significant growth as it provides a direct connection to the vehicle's diagnostics system, allowing for accurate data collection. Smartphone-based UBI is also gaining popularity due to its convenience and ease of use for both consumers and insurance providers. Hybrid models combine different technologies to offer a comprehensive approach to usage-based insurance, while black-box systems continue to be a reliable option for data collection in vehicles.

- By vehicle type, the market can be categorized into passenger vehicles and commercial vehicles. The passenger vehicle segment dominates the market, driven by the increasing adoption of connected car technologies and the growing demand for personalized insurance solutions among individual car owners. Commercial vehicles are also adopting usage-based insurance to optimize fleet management, improve driver behavior, and reduce operational costs.

- Geographically, the usage-based insurance for the automotive market can be divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America holds a significant market share, fueled by the presence of key players, advanced telematics infrastructure, and supportive government regulations. Europe is also a lucrative market due to the high adoption rate of connected car technologies and the increasing focus on road safety initiatives. The Asia Pacific region is witnessing rapid growth driven by the booming automotive sector and the rising awareness about insurance telematics.

**Market Players**

- Some of the prominent players in the global usage-based insurance for automotive market include Progressive Casualty Insurance Company, Allstate Insurance Company, State Farm Mutual Automobile Insurance Company, Liberty Mutual Insurance Company, Nationwide Mutual Insurance Company, General Motors, UnipolSai Assicurazioni S.p.A., Desjardins Assurances, Insure The Box Limited, and AXA. These market players are focusing on strategic partnerships, product innovations, and geographic expansions to gain a competitive edge in the market and cater to the evolving needs of customers.

https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-for-automotive-marketIn addition to the segmentation based on technology, vehicle type, and geography, the global usage-based insurance for the automotive market can also be classified based on the types of insurance coverage offered. This segmentation is crucial as it reflects the diverse needs of consumers and allows insurance providers to tailor their offerings accordingly. Some of the common types of insurance coverage in the usage-based insurance market include pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD) policies. PAYD policies calculate insurance premiums based on the actual distance driven by the insured vehicle, providing a cost-effective option for low-mileage drivers. PHYD policies assess driving behavior such as speed, acceleration, and braking patterns to determine insurance rates, encouraging safer driving habits among policyholders. MHYD policies offer a more comprehensive approach by combining both distance and driving behavior metrics to customize insurance premiums based on individual driving profiles. The availability of these varied insurance coverage options reflects the shift towards more personalized and transparent insurance solutions in the automotive industry.

Furthermore, another significant aspect of market segmentation in the usage-based insurance for automotive sector is the analysis of consumer demographics and behavior. Understanding the demographics of consumers who are more inclined towards adopting usage-based insurance can help insurance providers target their marketing efforts effectively and design products that resonate with the preferences of specific consumer segments. For instance, younger drivers and tech-savvy individuals are more likely to embrace usage-based insurance due to their familiarity with technology and willingness to try innovative solutions. On the other hand, older demographics may require more education and reassurance regarding data privacy and security concerns associated with telematics-based insurance products. By catering to the distinct needs and preferences of different consumer segments through targeted marketing strategies and product offerings, insurance companies can expand their market reach and drive adoption of usage-based insurance among a diverse customer base.

Moreover, the market segmentation of usage-based insurance for automotive can also delve into the regulatory landscape and industry standards that influence the adoption and growth of telematics-based insurance solutions. Government regulations regarding data privacy, cybersecurity, and insurance industry practices play a crucial role in shaping the competitive dynamics and market opportunities for insurance providers offering usage-based insurance products. Compliance with regulatory requirements and adherence to industry standards not only ensure consumer trust and protection but also facilitate seamless integration of telematics technology into the insurance ecosystem. Insurance companies that proactively engage with regulators, industry associations, and technology partners to address regulatory challenges and uphold best practices in data management and customer privacy are likely to establish themselves as trusted leaders in the evolving usage-based insurance market. By prioritizing regulatory compliance and ethical data usage, insurance players can build long-term relationships with customers and foster sustainable growth in the competitive landscape of automotive telematics insurance.**Segments**

Global Usage-Based Insurance for Automotive Market, Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD) and Manage-How-You-Drive (MHYD)), Technology (OBD II, Black Box, Smartphones and Others), Vehicle Type (Passenger Auto and Commercial Auto), and Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa) Industry Trends and Forecast to 2028.

The global usage-based insurance for the automotive market is experiencing significant growth and evolving across various segments. When it comes to technology, the market segmentation reveals a diverse range of options including OBD-II-Based UBI, smartphone-based UBI, hybrid models, black-box systems, and others. OBD-II-based UBI stands out for its direct access to the vehicle's diagnostics system, ensuring precise data collection. Smartphone-based UBI is gaining traction for its user-friendly interface, while hybrid models and black-box systems cater to specific needs within the market. Each technology segment offers unique advantages and appeals to different consumer preferences.

In terms of vehicle type segmentation, the market distinguishes between passenger vehicles and commercial vehicles. The dominance of the passenger vehicle segment is driven by the growing adoption of connected car technologies and personalized insurance solutions among individual car owners. Commercial vehicles are also incorporating usage-based insurance to streamline fleet management, enhance driver behavior, and lower operational costs. This segmentation highlights the tailored approach of usage-based insurance based on the distinct needs of different vehicle types.

Geographically, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America leads the market share due to established players, advanced telematics infrastructure, and supportive regulations. Europe follows closely with high adoption rates of connected car technologies and a focus on road safety initiatives. The rapid growth in the Asia Pacific region is fueled by a flourishing automotive sector and increased awareness of insurance telematics. These geographical segments showcase the diverse landscape of the global usage-based insurance market.

The analysis of consumer demographics and behavior is another crucial aspect of market segmentation in the usage-based insurance for the automotive sector. Understanding the preferences and tendencies of different consumer segments can help insurance providers tailor their offerings and marketing strategies effectively. Younger and tech-savvy consumers are more inclined towards adopting usage-based insurance, while older demographics may require more education on data privacy concerns. By catering to specific consumer segments, insurance companies can expand their market reach and drive adoption of usage-based insurance among a diverse customer base.

Moreover, regulatory landscape and industry standards play a pivotal role in shaping the competitive dynamics of the usage-based insurance market. Government regulations on data privacy, cybersecurity, and industry practices influence the opportunities for insurance providers offering telematics-based solutions. Compliance with regulatory requirements and ethical data usage are essential for building consumer trust and ensuring sustainable growth in the market. Insurance companies that prioritize regulatory compliance and data protection are likely to emerge as leaders in the evolving landscape of usage-based insurance.

In conclusion, the segmentation of the global usage-based insurance for the automotive market across technology, vehicle type, geography, consumer demographics, and regulatory landscape provides a comprehensive understanding of the market dynamics. The diverse segments offer insights into the evolving needs of consumers, the competitive landscape, and the regulatory environment shaping the future of usage-based insurance in the automotive industry. Keeping abreast of these market segments is key for insurance providers to innovate, expand their offerings, and stay ahead in a dynamic and competitive market.

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Usage-Based Insurance for Automotive Market Landscape

Part 04: Global Usage-Based Insurance for Automotive Market Sizing

Part 05: Global Usage-Based Insurance for Automotive Market Segmentation By Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Key takeaways from the Usage-Based Insurance for Automotive Market report:

- Detailed considerate of Usage-Based Insurance for Automotive Market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

- Comprehensive valuation of all prospects and threat in the

- In depth study of industry strategies for growth of the Usage-Based Insurance for Automotive Market-leading players.

- Usage-Based Insurance for Automotive Market latest innovations and major procedures.

- Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

- Conclusive study about the growth conspiracy of Usage-Based Insurance for Automotive Market for forthcoming years.

Browse Trending Reports:

Radio Frequency Identification Rfid Tags For Livestock Management Market

Frozen Fruit And Vegetables Mix Market

Needle Based Biopsy Gun Market

Perrault Syndrome Treatment Market

Gesture Based Technology Market

Synthetic And Biodegradable Marine Lubricants Market

Uterine Cancer Diagnostics Market

Flexographic Printing Ink Market

Office Based Surgical Product Market

Aerospace Interior Adhesive Market

Automotive Diagnostic Scan Tools Market

Cloud Based Workload Scheduling Software Market

Engineered Fluids Fluorinated Fluids Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"